On top of that, if you are charging everyone in Euros, you would also be hit by a currency conversion fee from, for example, USD to EUR. Moreover, if you are based in Europe but the bulk of your customers are based outside Europe, you will also be paying the cross border fee on top of paying more in basic fees. Malta: also a Eurozone country, so fees are identical to those of SpainĪs a side note, note that is very advantageous to have your PayPal account based in the US from a fee perspective, you get to pay 0.5% less than your European counterparts on the value of the transaction and also a lower fixed fee per transaction.

PAYPAL FEES CALCULATOR PLUS

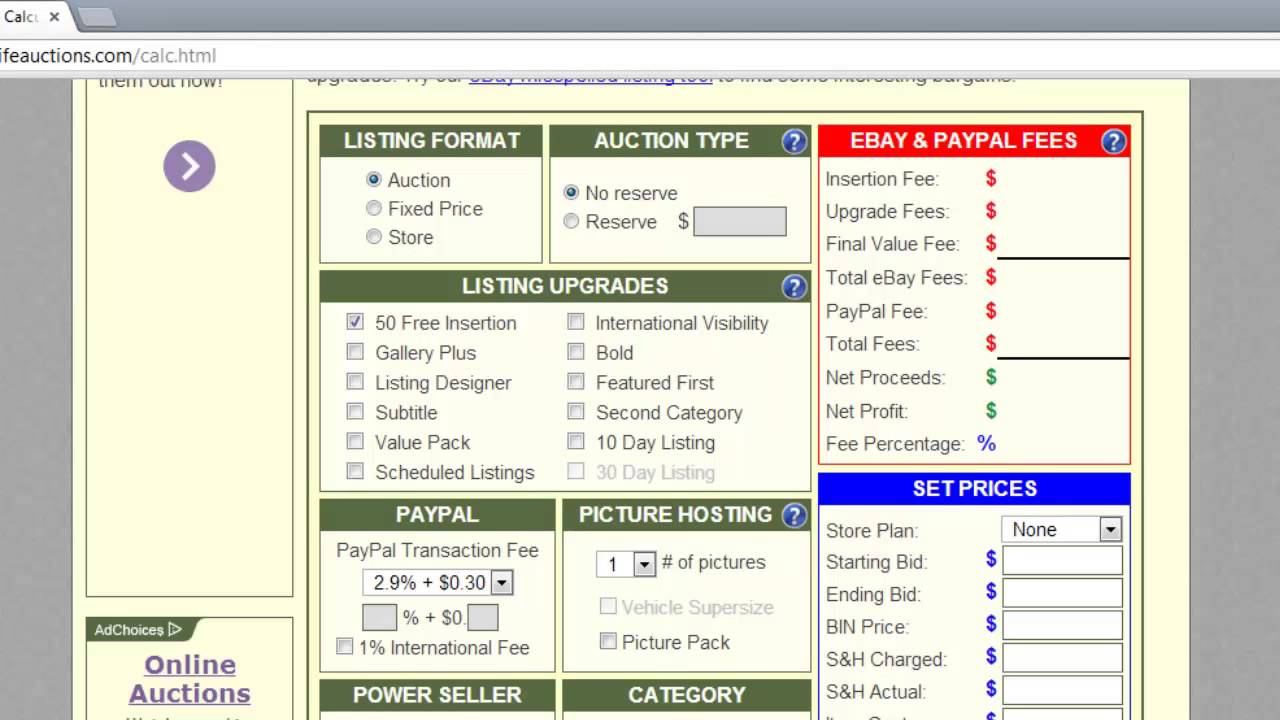

US: 2.9% plus $0.30 USD per transaction.We’ve already talked briefly about the first scenario above, and to give you an idea here’s what you would be paying if you were based in the following countries: I’ve also discussed the fourth scenario in previous articles on this site. I am mostly concerned about the accepting payments for your business with PayPal, so I won’t be discussing the third scenario.

But first, a short recap on the fees that PayPal imposes in general. In this post I’ll explain PayPal’s cross border fee system.

0 kommentar(er)

0 kommentar(er)